Remaining mortgage calculator with extra payments

We also generate graphs summaries of balances payments and interest over the life of your mortgage. Extra payments are additional payments in addition to the scheduled mortgage payments.

Mortgage Payoff Calculator With Extra Principal Payment Free Template

The actual amount will still depend on your affordability.

. Who This Calculator is For. According to the results youll prepay your mortgage by 3 years and 7 months if you make extra payments of 100 at the start of your mortgage. Borrowers can make these payments on a one-time basis or over a specified period such as monthly or annually.

Who This Calculator is For. Mortgage Amount or current balance. Use our extra mortgage payment calculator to see how fast you can pay off your mortgage with additional monthly payments.

Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more than 65000 in interestcha-ching. Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600. Making biweekly mortgage payments is a strategy that can help you save a lot of money in interest and pay off your mortgage early.

Bi-weekly payments will shave a few years from a 30-year mortgage and is relatively painless. If the first few years have passed its still better to. This adds 5500 to your monthly payments.

Interest-only loans are structured as adjustable-rate mortgagesWe also offer an I-O ARM calculator and a traditional ARM loan calculatorWith interest-only loans homeowners do not build equity in their homes unless prices rise which puts them in a precarious position if house prices fall or when mortgage rates rise. Extra payments count even after 5 or 7 years into the loan term. Yet while the thought of paying down your mortgage faster and living in your home without a mortgage sounds great there can be reasons why making extra payments toward the principal might not make sense.

What This Calculator DoesThis calculator provides amortization schedules for. With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage. For instance you decide to add a maximum of 200 to your.

Its also easier to budget because you can decide how much additional payments you can put each month. Ultimately significant principal reduction cuts years off your mortgage term. Extra payments can possibly lower overall interest costs dramatically.

Borrowers who want an amortization schedule or want to know when their loan will pay off and how much interest they will save if they make extra voluntary payments in addition to their required monthly payment. This bi-weekly pattern is distinct from a bimonthly mortgage payment which may or may not involve extra payments. Borrowers who want an amortization schedule or want to know when their loan will pay off and how much interest they will save if they make extra voluntary payments in addition to their required monthly payment.

If you own real estate and are considering making extra mortgage payments the early mortgage payoff calculator below could be helpful in determining how much youll need to pay and when to meet a certain financial goal. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Mortgage Payoff Calculator 2a Extra Monthly Payments.

What This Calculator DoesThis calculator provides amortization schedules for. Lets say you have a 220000 30-year mortgage with a 4 interest rate. Building a Safety Buffer by Making Extra Payments.

Connect with our friends at Clever Real Estate for a local agents expert opinion and a free. Make Bi-Weekly Payments on Your Current Mortgage. Meanwhile youll cut 2 years and 9 months from your term when you start making extra payments by the 6th year.

And the earlier you reduce the principal the faster you will reduce interest charges. You may also enter extra lump sum and pre-payment amounts. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

You can check the current mortgage rates here. This is a practical option if you do not have large extra funds. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US.

You can opt to add an extra amount on top of your monthly mortgage payment. Additional Regular Monthly Payments. For example a one-time additional payment of 1000 towards.

While both scenarios shorten your payment term making additional payments at the beginning of your mortgage saves more. Is approaching 400000 and interest rates are hovering around 3. If your monthly payment is 1000 per month and you pay.

Sometimes its good to make extra mortgage payments but not always says Kristi Sullivan of Sullivan Financial Planning in Denver. Private Mortgage Insurance also known as Lenders Mortgage Insurance tends to be around 55 per month per 10000000 financed. Note that this not an official estimate.

Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Interest rate is the annual interest rate of your mortgage loan given in percentage.

Instead of making one payment every month youll be making a payment every other week. Mortgage Payoff Calculator 2a Extra Monthly Payments. Biweekly paymentsThe borrower pays half the monthly payment every two weeks.

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization. Extra payments spill over to your principal balance. If you can pay an extra 100 per month towards principal on a 100000 30-year mortgage the average time shaved from the loan is nine years.

There are optional inputs in the Mortgage Calculator to include many extra payments and it can be helpful to compare the results of supplementing mortgages with or without extra payments. Making extra payments can drastically reduce your loan term and save you a tremendous amount on interest charges. Mortgage Calculator with Lump Sums.

Make Extra House Payments.

Mortgage Repayment Calculator

Mortgage Payoff Calculator With Line Of Credit

Mortgage With Extra Payments Calculator

Early Mortgage Payoff Calculator Be Debt Free Mls Mortgage

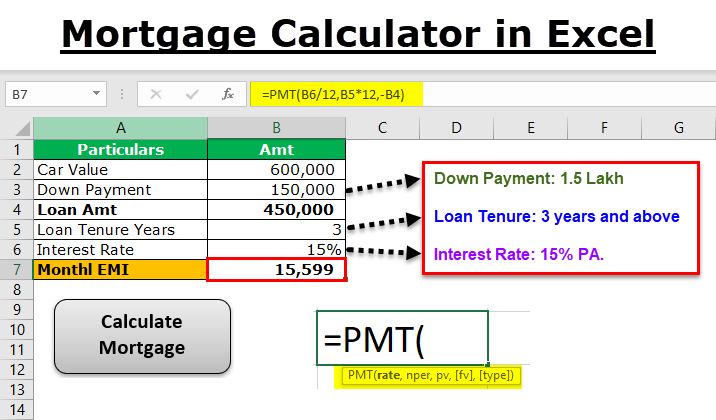

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Mortgage Payment Formula Excel Online 56 Off Www Ingeniovirtual Com

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Extra Payment Mortgage Calculator For Excel

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Free Interest Only Loan Calculator For Excel

Biweekly Mortgage Calculator

Komentar

Posting Komentar